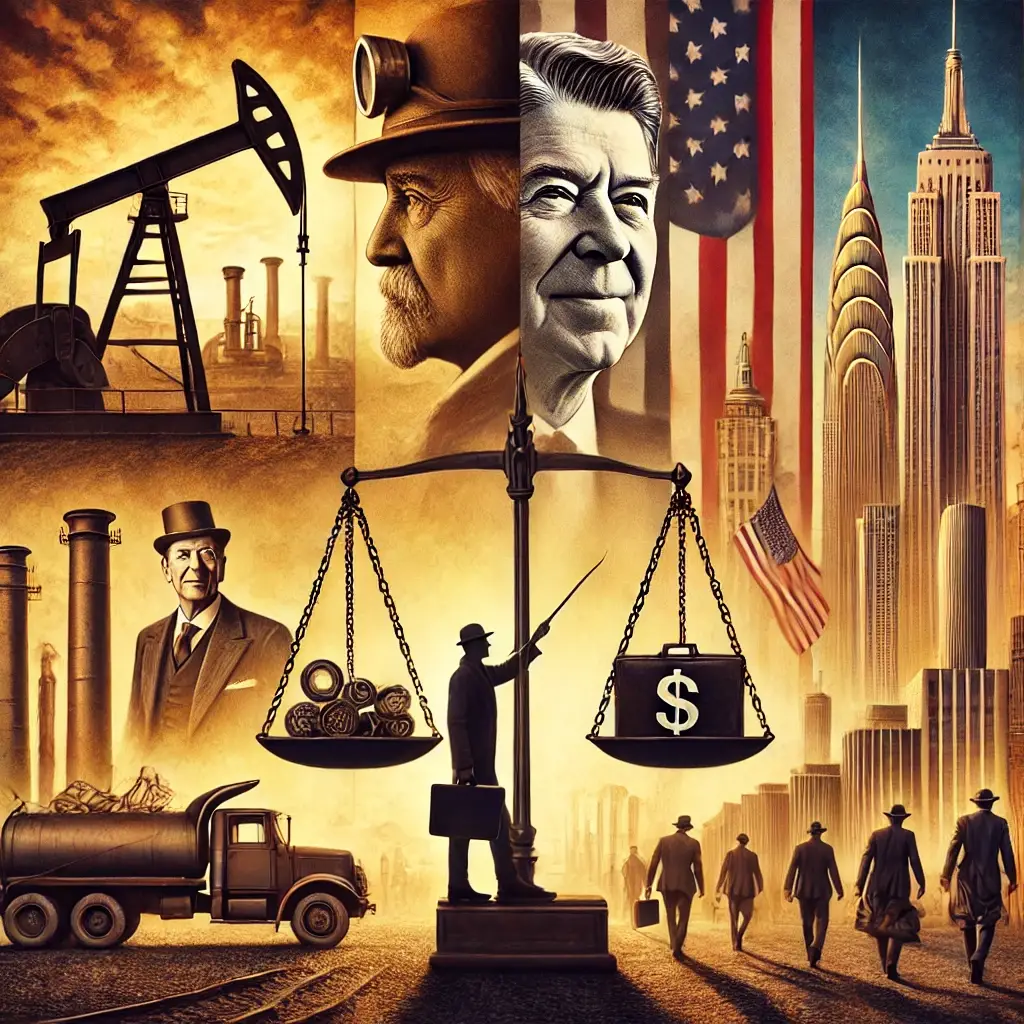

American history is filled with visionaries—individuals who dared to dream bigger, build stronger, and think beyond their time. John D. Rockefeller and Ronald Reagan stand as titans of their respective eras. Rockefeller revolutionized industry and philanthropy, while Reagan reshaped the relationship between government and the economy. Their intentions were noble, their achievements groundbreaking. Yet, the systems they helped shape unintentionally set the stage for a form of capitalism that is now teetering on the brink of collapse.

This isn’t about blaming two men for today’s challenges; it’s about understanding how well-intentioned decisions can have far-reaching and unintended consequences. This is the story of how wealth became entangled with governance, and why it’s time to chart a new course.

Part I: Rockefeller and the Rise of Wealth as Influence

The Visionary Industrialist

John D. Rockefeller was a man of unparalleled ambition and foresight. Through Standard Oil, he created efficiencies that revolutionized the energy industry. He didn’t just build a company—he built an empire that powered a nation’s growth. His work ethic, strategic mind, and innovative practices were unmatched.

But with great success came great power. Standard Oil’s dominance was so profound that it reshaped industries and even influenced governance. Rockefeller himself steered clear of political office, but his wealth and corporate clout had a profound impact on policy decisions.

The Unintentional Legacy

Rockefeller’s era was one of unprecedented wealth accumulation. It inspired the creation of antitrust laws like the Sherman Antitrust Act to curb corporate monopolies. While these laws aimed to address economic imbalances, they didn’t fully account for how wealth could influence politics in subtler ways—through lobbying, donations, and economic leverage.

The Gilded Age Landscape

Rockefeller’s success epitomized the Gilded Age, a time when industrialists amassed unimaginable fortunes while economic inequality soared. It was a period of innovation, but also of imbalance. This set the stage for future generations of wealthy individuals to use their resources not just for business but to shape policy.

Part II: The Reagan Revolution

Good Intentions, Lasting Impact

Fast forward to the 1980s, and Ronald Reagan sought to unleash the potential of American enterprise with his trickle-down economic policies. Reagan believed in the power of the individual and the marketplace. His tax cuts and deregulation were designed to encourage investment, innovation, and economic growth.

The Missing Safeguards

However, Reagan’s vision lacked safeguards. Without mechanisms to ensure that the wealth generated at the top would benefit the middle and lower classes, much of it stayed concentrated among the elite. Shareholder profits took precedence over reinvestment in workers and communities, accelerating the wealth gap.

Institutionalizing Wealth’s Influence

Reagan’s policies also legitimized corporate lobbying and campaign financing as a normal part of politics. These practices solidified the feedback loop between wealth and governance, where money didn’t just influence politics—it shaped it outright.

Part III: The Present Day and the Need for a New Path

From Good Intentions to Systemic Consequences

The systems Rockefeller and Reagan helped create were rooted in progress and optimism. But over time, these systems have spiraled into what we now call Feudalist Capitalism. Wealth concentration has reached levels not seen since the Gilded Age, and the disparity is destabilizing our economy and society.

Feudalist Capitalism in Action

Today, billionaires hold more power than nations, and corporations often drive legislative agendas. This isn’t capitalism as it was intended—it’s a distortion. It’s a system that rewards hoarding over reinvestment, speculation over sustainability.

Responsible Capitalism: A Way Forward

The solution isn’t to abandon capitalism—it’s to refine it. By learning from Rockefeller and Reagan’s legacies, we can implement measures to prevent excess and encourage reinvestment. Policies like the Equity Equation Project aim to strike a balance, ensuring that capitalism works for all, not just a select few.

Conclusion: Honoring the Vision, Correcting the Course

John D. Rockefeller and Ronald Reagan were visionaries who acted with the best of intentions. Their legacies remind us that progress requires not just innovation but also accountability. It’s time to take the next step, to build a system that upholds the principles of capitalism while addressing its excesses. This isn’t about punishing success—it’s about ensuring that success uplifts everyone. By doing so, we can honor their visions and create a future worthy of their ambitions.

This isn’t about blaming two men for today’s challenges; it’s about understanding how well-intentioned decisions can have far-reaching and unintended consequences. This is the story of how wealth became entangled with governance, and why it’s time to chart a new course.

Share! Pass it along! That’s how this works! Let it begin!